India in 2025 isn’t just about technological progress, political shifts, or social transformation—it’s also the stage for an economic battle between two of its most powerful industrial titans: Gautam Adani and Mukesh Ambani. Their companies, Adani Group and Reliance Industries, are not just conglomerates—they are empires that dictate the flow of billions, shape policy corridors, and increasingly, influence the nation’s strategic trajectory.

The world is watching. The question isn’t just “who’s richer?”—but who’s reshaping India’s future?

The Billionaire Background: Gautam Adani and Mukesh Ambani Two Men, Two Empires

Mukesh Ambani – The Legacy Giant

- Chairman and MD of Reliance Industries, the flagship company founded by Dhirubhai Ambani in 1966.

- Inherited the oil-to-retail empire and transformed it into a tech-first conglomerate with Reliance Jio, Reliance Retail, and ventures in green hydrogen.

- Estimated net worth in 2025: $117 billion, according to Forbes.

- Focus areas: Telecom, digital platforms, energy transition, retail, and entertainment.

Gautam Adani – The Meteoric Rise

- Founder and Chairman of Adani Group, which started as a trading firm in 1988.

- Rose rapidly post-2014, expanding into infrastructure, ports, airports, power, renewables, data centers, and defense.

- Despite market setbacks in 2023, bounced back and restructured aggressively.

- Estimated net worth in 2025: $83 billion and climbing.

Key Sectors of Rivalry in 2025

Let’s explore the areas where the Gautam Adani and Mukesh Ambani rivalry has become most intense—and where the consequences for India’s future are most significant.

🇮🇳 “Indian Billionaires 2025: Top 10 Richest People & Business Empires in India”

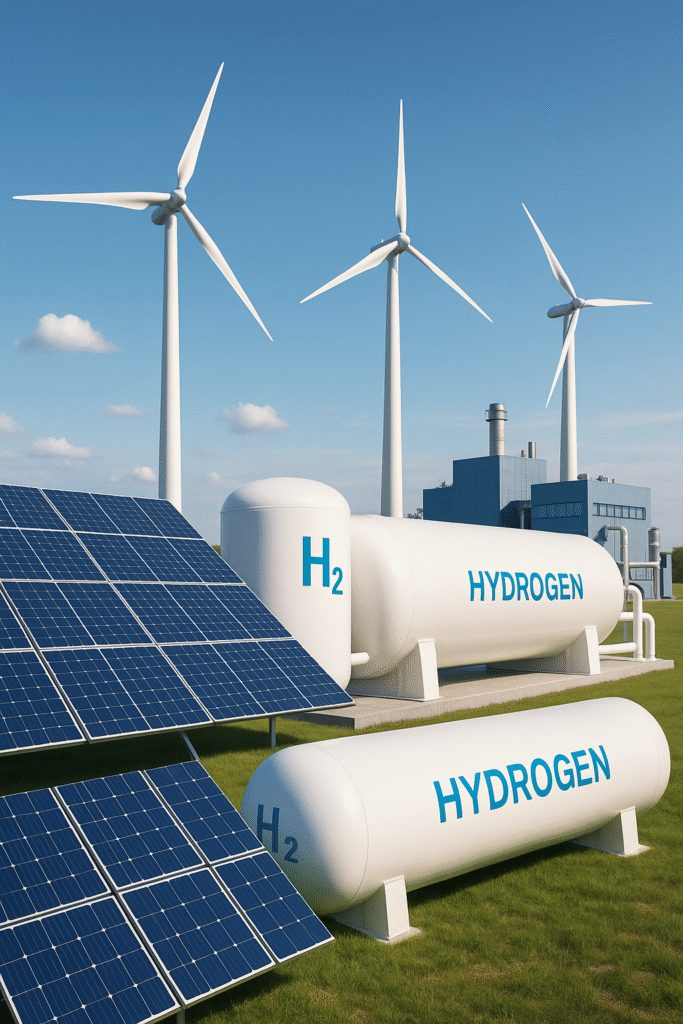

1. Energy: Green is the New Gold

Both Gautam Adani and Mukesh Ambani have declared green energy supremacy as their mission.

Adani’s Edge

- Adani Green Energy is building the world’s largest renewable energy park in Gujarat (Khavda).

- Has secured international backing (TotalEnergies, Abu Dhabi’s IHC).

- Massive solar, wind, and hybrid energy capacity — target of 45 GW by 2030.

Ambani’s Counter

- Reliance New Energy Ltd is investing $10 billion in green hydrogen, battery storage, and solar manufacturing.

- Acquisitions of REC Solar and partnerships with global firms.

- Green hydrogen strategy is aligned with India’s National Hydrogen Mission.

🡺 Impact: India’s future energy independence may lie in the hands of either Adani or Ambani—or both. Their projects are defining the country’s path to net zero by 2070.

2. Digital India: Jio vs Adani Digital

Mukesh Ambani’s Digital Empire

- Jio Platforms remains India’s largest mobile network with over 500 million users.

- JioCinema, JioMart, and JioFiber are household names.

- Partnerships with Facebook (Meta), Google, and Microsoft strengthened the digital backbone.

Adani’s Digital Ambitions

- Building data centers under AdaniConneX, in partnership with EdgeConneX.

- Eyeing enterprise cloud, AI, and 5G infrastructure from a B2B lens.

- Acquired stakes in NDTV and other media outlets to control narrative and influence.

🡺 Impact: If Jio is consumer-facing, Adani is betting on back-end infrastructure. Their strategies complement and compete, and together they influence how India consumes, stores, and transmits data.

Antilia House: India’s Billionaire Skyscraper and the Stories Behind It

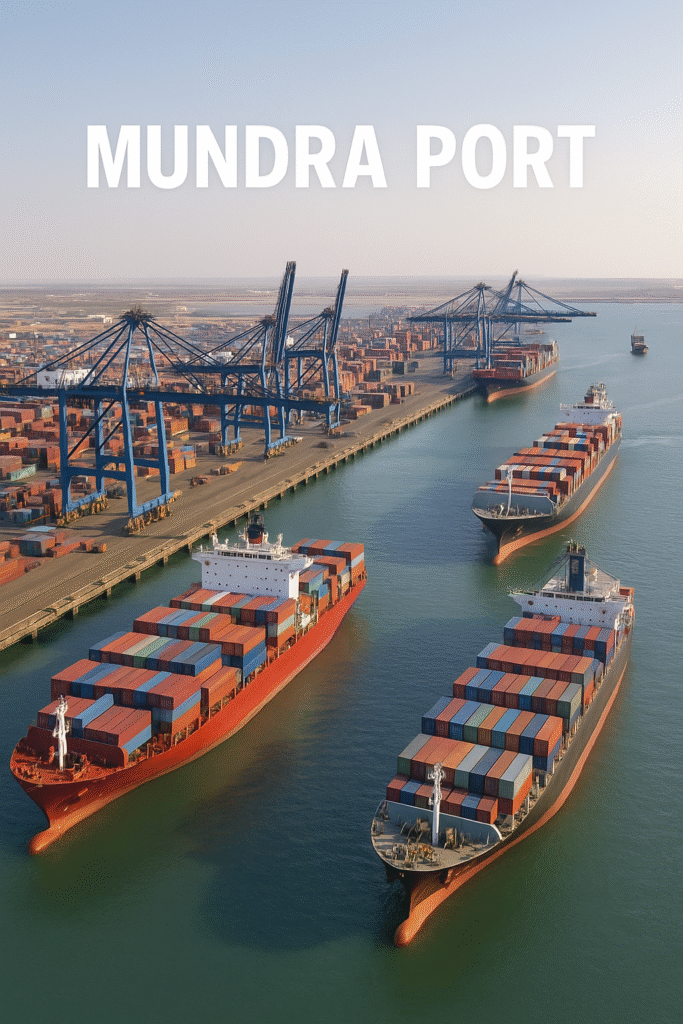

3. Ports vs Retail: Sea Routes and Storefronts

Adani Ports and SEZ Ltd

- India’s largest port operator with control over 24% of cargo movement.

- Operates 13 ports, including India’s largest—Mundra Port.

- Key asset for national logistics and defense ambitions.

Reliance Retail’s Market Domination

- With over 18,000 stores, Reliance Retail is India’s largest retailer.

- Crosses $35 billion revenue in FY2024–25.

- Ventures into e-commerce, quick commerce, and wholesale distribution.

🡺 Impact: Adani owns the gateways to India; Ambani controls what flows inside. From logistics to last-mile delivery, both play critical roles in national supply chains.

4. Media and Influence: Controlling the Narrative

- In 2022–23, Adani shocked the media world by acquiring NDTV, one of India’s oldest and most respected news brands.

- Ambani’s Network18 already runs CNN-News18, CNBC-TV18, Colors, and other key TV networks.

- Both tycoons now influence how news, entertainment, and public sentiment are shaped.

🡺 Impact: With rising political and social polarization, media control is as strategic as oil or data. Both are keen to ensure their brands and policies enjoy the upper hand in the public eye.

5. Political Influence and Regulatory Clout

- Adani’s meteoric rise is often seen as aligned with India’s current political leadership, leading to criticism about crony capitalism.

- Ambani, by contrast, is known for long-standing influence across political regimes—quiet but powerful.

- Their moves trigger stock market reactions, policy tweaks, and even global scrutiny.

🡺 Interesting Story:

When the Hindenburg report hit Adani Group in early 2023, wiping out over $100 billion in market cap, Mukesh Ambani’s firms gained $7–8 billion in valuation as investors shifted bets. But within a year, Adani recovered almost 70% of his losses by restructuring debt, selling stakes to GQG Partners, and tightening governance.

Global Footprints: Expanding Beyond India

Ambani’s Global Play

- Jio has aspirations for global digital leadership, with tie-ups in Africa and Southeast Asia.

- Reliance is expanding its footprint in green energy manufacturing, exporting to the Middle East and Africa.

Adani’s International Vision

- Operates port terminals in Australia, Sri Lanka, and Israel.

- Builds solar factories in the US, and logistics parks in UAE and Bangladesh.

🡺 Impact: Both billionaires are reshaping India’s global image, proving Indian conglomerates can play in the big leagues.

Different Leadership Styles

- Ambani is calculated, private, and legacy-oriented. His strategy involves horizontal expansion—capturing all consumer verticals from telecom to retail to entertainment.

- Adani is bold, aggressive, and risk-taking. His strategy is infrastructure-first—own the essentials: roads, ports, airports, energy, data centers.

🡺 Both represent two versions of Indian capitalism: one rooted in family-run legacy and the other driven by infrastructure-fueled ambition.

What Do Indians Think? Public Perception in 2025

- Ambani is seen as a household name, with deep roots in India’s economic journey.

- Adani is viewed as the “new tycoon”, controversial yet admired for boldness.

- Online sentiment is mixed—Adani’s rapid rise sparks curiosity and conspiracy; Ambani’s digital reach offers comfort and familiarity.

🡺 Social Media Note: In 2025, hashtags like #AmbaniEmpire and #AdaniPowerWar trend regularly on X (formerly Twitter), with memes, debates, and analysis flooding timelines.

🔋 Who’s Winning the Sustainability Race?

In 2025, sustainability isn’t just a buzzword—it’s the new battlefield. Both Gautam Adani and Mukesh Ambani are racing to become leaders in India’s green future, but they’re taking different approaches.

🌞 Adani’s Massive Renewable Push

- Adani Green Energy has become India’s largest renewable energy firm.

- Massive projects like the Khavda Solar Park (45 GW target) are nearing full capacity.

- Global investors including TotalEnergies, IHC, and GQG Partners continue backing Adani’s green vision.

⚡ Ambani’s Green Hydrogen and Battery Play

- Reliance New Energy is producing green hydrogen in Jamnagar at pilot scale.

- Huge investments in battery storage, electrolyzers, and solar modules.

- Acquisitions across Europe and the US to build a vertically integrated green energy ecosystem.

🡺 Verdict: Ambani is betting big on tech-led green chemistry, while Adani is focused on scale and infrastructure. Both are vital to India’s climate goals, but Adani leads in installed capacity, and Ambani leads in futuristic innovation.

👨👩👧👦 Succession Planning: The Next Generation

Both business Gautam Adani and Mukesh Ambani empires are preparing for life beyond the founder, and their successors are already playing key roles in 2025.

🧑💼 Ambani Family

- Akash Ambani: Heads Jio Platforms, focusing on digital services and telecom.

- Isha Ambani: Leads Reliance Retail, spearheading expansion into fashion, beauty, and global e-commerce.

- Anant Ambani: Oversees new energy initiatives, green hydrogen, and Jamnagar projects.

- Mukesh Ambani is now Chairman Emeritus, guiding the transition with stability and foresight.

👨💼 Adani Family

- Karan Adani: CEO of Adani Ports & SEZ, and now involved in airport and logistics integration.

- Instrumental in Adani Airport Holdings and the AdaniConneX data center JV.

- Gautam Adani remains at the helm but increasingly delegates high-level operational control to Karan and senior executives.

🡺 Impact: Both groups are undergoing smooth generational transitions, with a focus on keeping their empires family-controlled yet professionally managed.

Visit Kaziranga National Park – The Kingdom of the One-Horned Rhino

🔥 Top 3 Turning Points in Their Rivalry

1. Jio Launch vs. Adani’s Infrastructure Boom (2016–2018)

- Jio revolutionized India’s internet, while Adani quietly expanded into ports, logistics, and energy.

- This was the beginning of their parallel growth story—one consumer-centric, the other infrastructure-led.

2. 2020–2023: Pandemic, Jio’s Funding Blitz, Adani’s Rise

- Reliance raised $20 billion from Meta, Google, and others.

- Adani expanded aggressively into airports, media, and green power.

- Ambani solidified digital dominance, Adani became India’s infrastructure czar.

3. Hindenburg Report Fallout (2023)

- A US-based short-seller accused Adani Group of stock manipulation and accounting fraud.

- Adani lost over $100 billion in market cap within weeks.

- By 2025, he recovered by deleveraging, selling stakes, and restructuring — showing resilience that cemented his long-term credibility.

⚖️ Power Matrix: Who Controls What in 2025?

| Sector | Adani Group | Reliance Industries |

|---|---|---|

| Energy | 45 GW renewable capacity | Green hydrogen, solar, battery R&D |

| Telecom | Infra support via data centers | Jio, India’s largest telecom operator |

| Retail | Limited to B2B and airport retail | 18,000+ stores, e-commerce, FMCG |

| Media | NDTV, digital news startups | Network18, Viacom18, JioCinema |

| Ports | India’s largest private port operator | Minor presence |

| Airports | 7 major airports including Mumbai | None |

| Digital Infra | AdaniConneX data centers | Jio platforms, cloud, consumer apps |

| Defense | Defense manufacturing, drones, cybersec | None (minor exploration) |

🡺 Conclusion: Adani is stronger in physical infrastructure, while Ambani leads in consumer services and digital scale. Their paths rarely overlap—but when they do, sparks fly.

🌟 Hidden Wonders of Meghalaya: Exploring Uncharted Caves, Waterfalls & Villages in 2025

📉 Market Value in 2025 (Estimated)

| Name | Company Net Worth (Group-wide) | Personal Net Worth (USD) |

|---|---|---|

| Gautam Adani | ~$170 Billion | ~$83 Billion |

| Mukesh Ambani | ~$210 Billion | ~$117 Billion |

Despite Adani’s temporary fall in 2023, his 2024–25 rebound has been impressive. Ambani remains wealthier but not unchallenged.

🧠 Expert Opinions & Industry Projections

🔍 Economic Analysts Say:

- “India needs both. Adani builds the roads and ports, Ambani builds the apps and services that ride on them.” — Ruchir Sharma, global investor

- “Their rivalry is pushing India faster into self-reliance, digital infrastructure, and green growth.” — Economic Times editorial, Jan 2025

🔮 Projected Growth 2025–2030:

- Adani Group: Expanding in Africa, Middle East, and green logistics.

- Reliance: Betting big on AI, quantum computing, and global e-commerce partnerships.

📣 Public Buzz: The Billionaire Meme War

In 2025, both Gautam Adani and Mukesh Ambani are not just business names—they’re social media phenomenons. Every announcement by either triggers:

- Trending hashtags like #AdaniBack, #AmbaniBoss, #JioVsAdani

- Meme wars over port control, airport lounges, and retail pricing

- YouTube debates and podcasts: “Is Adani the new Ambani?”

🔥 Example:

When Adani Airports offered free EV charging in 2025 at Mumbai airport, JioMart responded with 15-minute grocery delivery promos. Twitter had a field day.

Why the Northeast Deserves More Attention in National Media

🇮🇳 What This Means for India’s Future

✅ The Positives:

- Massive job creation across sectors

- Acceleration in digital inclusion, green energy, and infrastructure

- India becoming a global economic power faster due to internal competition

⚠️ The Risks:

- Over-concentration of power in a few hands

- Media and political influence blurring democratic checks

- Possibility of crony capitalism, if not checked by regulation

🏁 Final Word: Who Wins the Battle?

There’s no single winner in 2025. The real winner is India—a nation witnessing unprecedented growth due to the bold ambitions of its two biggest billionaires.

- Ambani remains India’s richest and most consistent mogul, with a laser-sharp focus on consumers.

- Adani is India’s riskiest yet fastest-scaling entrepreneur, building the hard skeleton of the nation.

🥇 Verdict:

Ambani is the king of services.

Adani is the king of structures.

Together, they’re reshaping the nation.

🌄 Plan Your Trip to Northeast India with Us!

Want to explore the untouched beauty of the Northeast?

From the misty mountains of Mizoram to the living root bridges of Meghalaya, and the cultural heart of Assam — we’ve got you covered!

✅ Personalized Travel Itinerary

✅ Local Guides & 24/7 Support

✅ Best Hotel & Homestay Options

✅ Group Tours & Solo Packages

✅ Affordable, Safe & Hassle-Free

📩 Contact us today and let’s start planning your dream trip!

📞 Call/WhatsApp: 8453980642

🧳 Book your Northeast adventure now – Discover places you’ve only dreamed of!